Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Stablecoins are catching on -- but not where you'd expect:

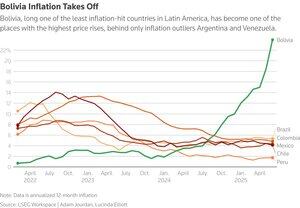

Bolivia is grappling with record-high, 25% inflation—the highest in over three decades—and a severe shortage of U.S. dollars. The crisis has eroded confidence in the boliviano and in the socialist government.

🪙Stables filling the gap

Against this backdrop, digital assets are increasingly being used not just for speculation but as practical tools for daily commerce and preserving value.

Everyday businesses—from beauty salons giving Bitcoin discounts to ATMs converting coins into crypto—demonstrate how digital currencies are integrated into daily life.

📈Remarkable transaction surge

Since Bolivia lifted its ban on cryptocurrencies in mid-2024, use of virtual assets in transactions has skyrocketed—soaring over 530%, from about $46 million in the first half of 2024 to $294 million in the same period of 2025. Total volumes have reached approximately $430 million across more than 10,000 operations.

☠️Risks and caution

Despite the surge, economists warn this trend is not a sign of economic stability. Instead, it's a reflection of Bolivians' diminishing purchasing power. Critics also highlight the volatility of crypto and the potential for exploitation, particularly affecting vulnerable communities.

🏦Institutional response

In a nod to crypto’s growing relevance, Bolivia’s central bank has signed a formal agreement with El Salvador to help craft a regulatory and technical framework for crypto adoption, drawing on El Salvador’s experience as the first country to make Bitcoin legal tender.

@twifintech @thestablecon

3,42K

Johtavat

Rankkaus

Suosikit