Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

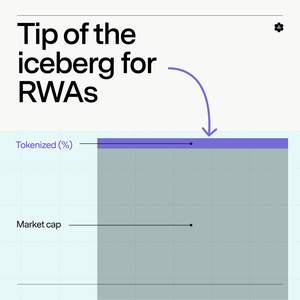

1/ RWAs are one of the hottest narratives in crypto.

But tokenized share is still under 0.01% across major asset classes, pointing to massive RWA growth potential.

Let’s explore a few below.

2/ RWAs are bridging the gap between TradFi and crypto, potentially bringing trillions of dollars onchain and democratizing access to institutional-level investment products.

There are several different kinds of RWAs that either have been or could be tokenized in the future.

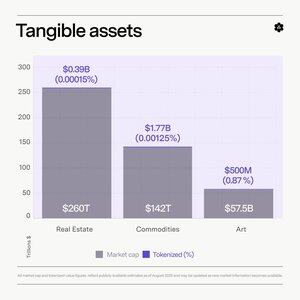

3/ Tangible, physical assets

Real estate: Tokenized RE allows for fractional ownership of properties, from commercial buildings to residential homes, democratizing access to RE investment and enhancing liquidity in an illiquid market.

Commodities: Physical goods like gold, silver, oil, and agricultural products can be tokenized, allowing for more efficient trading and ownership.

Art and collectibles: High-value art pieces, trading cards, and other collectibles can be tokenized, allowing more investors to hold shares in these traditionally exclusive assets.

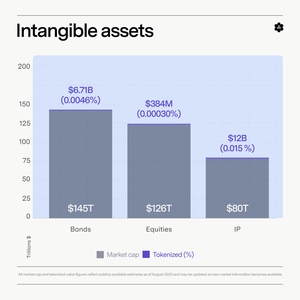

4/ Intangible assets

Bonds and fixed income: Tokenization of government and corporate bonds makes them more accessible to a global investor base and enables more efficient issuance and trading.

Equities: Company shares can be represented as tokens, streamlining settlement processes and enabling 24/7 trading.

Intellectual property: Patents, copyrights, trademarks, and royalty streams can be tokenized, creating new ways to monetize and invest in creative and innovative works.

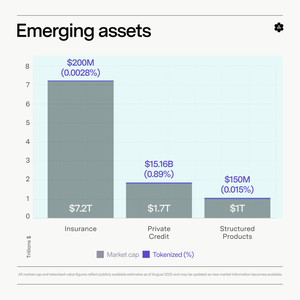

5/ Emerging RWA categories

Insurance policies: Tokenized insurance contracts that can be traded and settled onchain.

Revenue shares: Tokens representing rights to future revenue streams from businesses or projects.

Structured products: Complex financial instruments combining multiple asset types with specific risk-return profiles.

6/ Last but not least: Stablecoins

Stablecoins are already one of the biggest and most widely used categories of crypto assets, with most pegged to the U.S. dollar.

Stablecoins come in several varieties. Fiat-backed stablecoins like USDT and USDC, for instance, are backed by reserves of the underlying currency held in bank accounts or invested in yield-bearing instruments like treasuries.

Others, like Paxos Gold (PAXG), are backed by physical commodities such as gold.

7/ The diversity of RWAs demonstrates the flexibility of blockchains, as virtually any asset can be tokenized in order to enhance its accessibility and liquidity.

8/ Want more? Read our Guide to RWAs:

5,42K

Johtavat

Rankkaus

Suosikit