Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

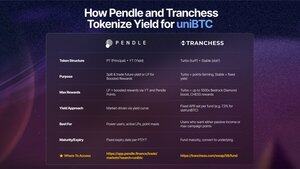

1/5 Ever heard of yield tokenization but not sure what it actually means? 🤔

Let’s break it down using $uniBTC across two protocols, @pendle_fi and @Tranchess, both aiming to unlock the full potential of your $BTC yield 🧵👇

2/5 Deposit $uniBTC into a @pendle_fi pool, and it splits into:

🔹 PT = Principal Token ➡️ redeemable for full uniBTC at maturity

🔹 YT = Yield Token ➡️ lets you trade or farm the future yield

You can also LP the pair for stacked rewards.

3/5 Meanwhile, on @Tranchess, you can deposit $brBTC or $uniBTC into a fund and pick your lane:

🔸 Turbo Point (turP) ➡️ farm multipliers like Bedrock Diamonds

🔸 Stable Yield (staY) ➡️ lock in a fixed APY

You can also LP for $CHESS rewards, trading fees, interest, and Diamond boosts.

4/5 So, how do you choose between the two?

✅ If you want structured, fixed yield and multi-chain flexibility: @pendle_fi

✅ If you want to farm points hard on @BNBCHAIN: @Tranchess

Don't worry, we've got the cheatsheet for you:

5/5 Choose the yield path that fits your game.

🧪 @pendle_fi Pools:

♟️ @Tranchess Funds & Liquidity Pools:

11,99K

Johtavat

Rankkaus

Suosikit