Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

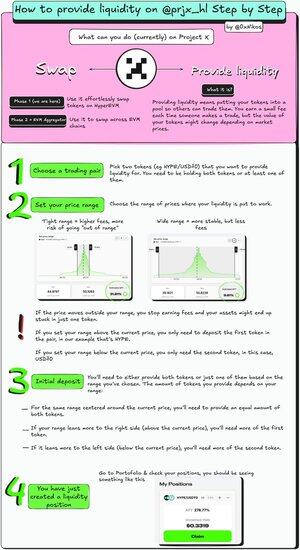

Providing liquidity on @prjx_hl | A visual guide

Below an attempt to explain as simply as possible what providing liquidity means and the steps you need to take to provide liq on Project X.

Honestly, I find the UX super intuitive but many may have not provided liquidity before so explaining it should help.

> In general, providing liquidity is a great way to farm fees especially on super volatile assets while at the same time slowly selling your position/accumulating more of your desired token without affecting the price (if position is large). A great way to DCA in and or out of a project.

Things to always monitor:

- Current price vs your range: If price moves outside your range, you're no longer earning. So you need to close/adjust your liq position

- Trading volume: More volume = more fees.

- Impermanent loss risk: Maybe a topic for another day, just know if prices shift a lot, you might end up with more of your less desired token and less of your desired one.

- Pool incentives: Some pools offer extra rewards i.e. $kHYPE from @kinetiq_xyz

Some tips if it's your first time:

- Start with wide ranges to avoid going inactive too quickly.

- Pick stable pairs (e.g. HYPE / USD₮0) if you're just experimenting, they’re less volatile.

- Don’t “set and forget.” Check your position every few days, especially in volatile markets.

--------

Hope this helps, tap/click the image to open it in full.

1,78K

Johtavat

Rankkaus

Suosikit