Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Vault of the Day ⟢ Gauntlet WETH on Unichain

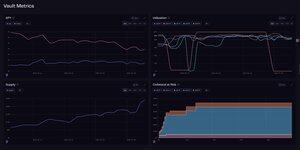

Today’s spotlight is the @gauntlet_xyz WETH vault on @unichain , a conservative yield vault powered by @MorphoLabs . It offers a steady ~3.7% net APY (after fees), backed by $24M in deposits and $10.9 M in liquidity. Core Vaults use a moderate risk strategy that balances yield and safety.

Core Competitive Yield Strategies allocate to a mix of large and small cap collateral markets, with active vault supply management to maintain liquidity. Designed for resilience, they ensure efficient liquidations even in adverse conditions. That means it seeks a balance between risk and return, allocating WETH across approved liquid staking tokens with known price behavior and collateral depth. It isn't about chasing highs. It's about maintaining performance in a predictable and measured way.

Current net APY sits at 3.67%, with a 7‑day average at 3.95% and a 30‑day average at 3.92%. There’s a 10% performance fee on yield, but no management or flat fees, just earnings from active market participation.

Risk wise, the vault hasn’t yet been scored by Credora, but the setup includes a 3-day timelock, onchain transparency, and allocation logic managed by Gauntlet. Vault version is Morpho v1.1. The total TVL curated by this manager currently sits above $662M.

This vault combines

@unichain low cost fast rollup (OP Stack Optimistic Rollup)

@gauntlet_xyz dynamic risk-weighted allocations

@MorphoLabs high efficiency lending rails

It brings together scalability, smart yield, and active risk mitigation under one roof

Why use it? Who’s it for?

If you're a DeFi user seeking:

Stable returns on WETH

Lower gas fees and faster transactions

A resilient, diversified lending strategy, this vault offers an accessible, efficient option.

Risk reminder: While @unichain uses @Optimism 's security and @MorphoLabs lending is overcollateralized, risks still exist: rollup delays during fraud proof windows, potential smart contract bugs, and liquidation slippage. But Gauntlet’s Core strategy actively adjusts to maintain buffer zones.

The Gauntlet WETH Vault on Unichain is a well designed entry point for WETH holders to earn yield affordably on a cutting edge rollup. It leverages Unichain's scalability, Morpho's lending model, and Gauntlet’s risk controls while offering users transparent metrics and credible yields.

6,64K

Johtavat

Rankkaus

Suosikit