Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Weston Nakamura

Founder, Across The Spread. 🌏markets analysis via 🇯🇵/Asia lens. Former derivatives trader @ Goldman & Jefferies + original content @ RealVision & Blockworks

Looks like I accidentally made it in the back door of being published in Nikkei

Not that that’s by any means a goal, let alone an interest of mine

“What to do about Trump’s $9tn debt dilemma”

by @IChronicle ←owned by @FT← owned by @nikkei

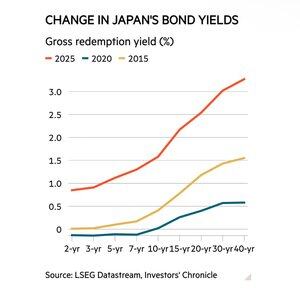

“Another important and perhaps overlooked risk for US Treasuries is the fallout from the Japanese Government Bond (JGB) market. When the Bank of Japan (BoJ) tapers its rollover of long-dated JGB holdings, retrenchment of a guaranteed buyer of last resort reveals weaker demand and forces up rates.

This has two important knock-on effects, argued Weston Nakamura, an expert on Japanese markets. The first is upward pressure on other developed market yields, something that is more consequential in the US (which due to US yields being the global risk-free rate affects other asset class valuations) than in Japan itself.

The second is market functioning and liquidity: the combination of Japan’s government adjusting the maturity profile of its own debt and the BoJ trimming its balance sheet has the potential to create volatility episodes that get exported.

Japan issues bonds in its own currency, so can’t default, and rampant inflation isn’t an issue (albeit cost of living still played a part in the government losing its upper house majority), so why does Japan need to change its policy course so dramatically?

The answer, suggests Nakamura, is the need to improve the functioning of capital markets. Past radical actions such as yield curve control flushed out key participants like market makers and arbitrage traders.

In order to reboot these essential workings of the financial system, and therefore the liquid capital flows Japan’s economy needs, the BoJ must lessen intervention and allow the free market to breathe.”

17,62K

This might sound a bit weird but 🇯🇵🤡Ishiba’s relentless refusal to step down as PM via his almost heroic level of dedication to very openly not giving A FUCK what 🇯🇵 wants / elects / demands etc - this sheer resolve is also helping prevent long-dated JGBs from cratering (though completely unintentional of course)

Personal view: 🇯🇵🤡PM Ishiba ain’t going nowhere anytime soon immediate ~ near term & maybe longer

That said - just be ready if he suddenly does find a sliver of shame, honor, legacy etc within - as it would trigger a violent repricing of JGB/global yields

Weston Nakamura25.7.2025

Background summary explaining why 🇯🇵JGBs are the world’s most dangerous market 👇

7,05K

Weston Nakamura kirjasi uudelleen

What’s going on with Japan's Prime Minister Ishiba? Is he resigning or not?

To clear up some confusion, here’s what we know: multiple legit Japanese media outlets across the political spectrum have reported he will quit, this month or next, after Sunday's disastrous election 1/

19,73K

Thanks for your 🇯🇵 visit this past election weekend that “didn’t have any trade negotiation activity etc”

Can you please finish your regime change mission & kick “Prime Minister” Ishiba out though?

Thank you sir.

-annoyed rooter/advocate for both 🇺🇸 & 🇯🇵

Treasury Secretary Scott Bessent23.7.2025

Thanks to @POTUS’s leadership, the United States has negotiated a historic agreement with Japan, one of our great allies.

Prime Minister @shigeruishiba and Minister @ryosei_akazawa worked hard with our trade team to secure this mutually beneficial partnership, for which we commend them.

I am happy to reaffirm our commitment to deepening this longstanding alliance and building the next chapter of U.S.-Japan cooperation as we enter a new Golden Age under President Trump.

6,39K

Lot of people (well maybe not a “lot…”) put out 🇯🇵commentary - much of which is nonsense

What makes the difference for the good ~ great are those who really try to dig in & seek out 🇯🇵nuances

But @peruvian_bull actually came to 🇯🇵boots on ground

Was honored to be part of this

Thanks Bull-san!

Roberto Rios (Peruvian Bull)12.7.2025

Will the Yen's Collapse Speed Up The Endgame?

featuring @acrossthespread, @kinetic_finance and myself!

special thanks to @Blockstream for sponsoring!

6,43K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin