Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jonaso

defi on-chain I edellinen @deloitte | Nyt @puffer_finance & @lombard_finance

Olen erittäin utelias, miksi $BNB @Bybit_Official osui jälleen ATH:han, mutta ihmiset silti häivyttävät sen ekosysteemiä.

Kaikki $MNT Econ jalokivet ovat edelleen piilossa, ja olen kiitollinen siitä, että minulla on enemmän aikaa asettaa matalia positioita ja kerätä lisää.

Bybitin $AERO ja $CAKE ovat edelleen vain 11 miljoonan dollarin markkina-arvossa.

- Yli 80 % kiertävästä tarjonnasta on panostettu.

- 100 % tuloista käytetään takaisinostoihin.

- Päästöt ovat vähentyneet 96 %.

Stablecoin/TVL-suhde = 3 → korkein kaikista lohkoketjuista tällä hetkellä.

hoeem5 tuntia sitten

Tässä on $MNT opinnäytetyö:

> MNT on ByBitille sama kuin BNB Binancelle.

> ByBitillä on 8 % CEX-osuus

> Binancella on 40 % CEX-osuudesta

> BNB mcap: 144 miljardia dollaria

> MNT mcap: 6,4 miljardia dollaria.

> Keskikäyrän matematiikka = MNT aliarvostettu

> MNT:n, jonka arvostus on sama kuin BNB:n, markkina-arvo olisi 28,8 miljardia dollaria.

> Se on 350 prosentin potentiaalinen nousu.

> En sano, että pääsemme sinne, mutta CEX-tokenin potentiaali ylituottoon on olemassa.

> MNT-kaavio näyttää hyvältä.

Jatkan "opinnäytetyön" julkaisemista nykyisistä laukuista, joista pidän markkinoilla, jos pidät tämän tyylisestä sisällöstä, lähetä roskapostia tykkäys-init.

6,52K

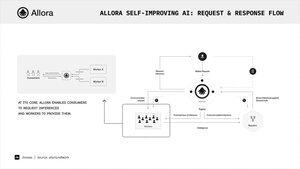

Allora rakentaa ensimmäistä itseään parantavaa tekoälyverkkoa ~, jossa älykkyydestä itsestään tulee likvidiä, vaihdettavaa ja palkittavaa

Miten @AlloraNetwork oikeastaan toimii?

Pohjimmiltaan Allora ei ole vain yksi tekoälyprotokolla ~ se on älykkyyden markkinapaikka

Sen sijaan, että Allora luottaisi yhteen malliin, se linkittää useita AI/ML-agentteja → pisteyttää niiden tulokset → ja syntetisoi tarkimmat päätelmät reaaliaikaisissa olosuhteissa

➥ Tämä muutos siirtää tekoälyn mallikeskeisestä → verkkokeskeiseksi

Virtaus on yksinkertainen mutta tehokas ↓

1️⃣ Pyyntö: Kuluttajat pyytävät päätelmiä (ennusteita, oivalluksia)

2️⃣ Vastaus: Työntekijät toimittavat heille koneoppimismallejaan käyttäen

3️⃣ Ennustaminen: Muut työntekijät ennustavat näiden päätelmien tarkkuuden.

4️⃣ Synteesi: Verkko kokoaa tulokset ja suodattaa kohinaa signaalista

5️⃣ Konsensus ja palkinnot: Oikeat, laadukkaat johtopäätökset palkitaan ketjussa

Tuloksena → itsestään kehittyvä tekoälykerros, joka:

+ Mukautuu markkinoiden kehittyessä

+ Kannustaa tarkkuuteen melun sijaan

+ Skaalaa älykkyyttä hajauttamalla

Allora = tekoäly, joka oppii markkinoiden kanssa, ei niitä vastaan

418

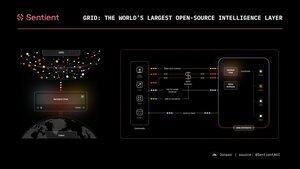

AGI ei ole yksittäinen malli, se on verkko

Se on GRID by @SentientAGI ~ maailman suurin avoimen lähdekoodin älykkyyskerros

Jo käytössä 110+ kumppanin → 50+ agentin, 50+ tiedontarjoajan, 6 tekoälymallin, 10+ laskenta- ja todennettavissa olevan infran kanssa

Jokainen kysely reititetään, rikastetaan, yhdistetään → tuottaa AGI-tason tuloksia tuhansien rakentajien avulla

Pääsy Sentient Chatin kautta. Rahoita artefakteja panostamalla $SENT. Palkkiot skaalautuvat todellisen käytön mukaan

GRID muuttaa avoimen tekoälyn kestäväksi taloudeksi

1,65K

Johtavat

Rankkaus

Suosikit