Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TokenLogic

We provide Capital Management Solutions for Institutions and DeFi Protocols.

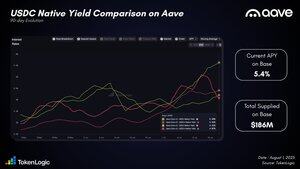

Now that the Incentive Campaign has been live since July 23, let’s take a closer look at how $USDC borrowing costs changed.

Quick reminder:

→ Native Borrow Rate = Borrow APY

→ Net Borrow Rate = Borrow APY - Incentives APR

As shown on the chart, both rates moved closely together before the campaign launched.

After July 23, the native borrow rate started rising, while the net borrow rate dropped below pre-campaign levels.

► The result?

Despite higher native rates, users are now paying less to borrow $USDC thanks to the Base Incentive Campaign.

13,69K

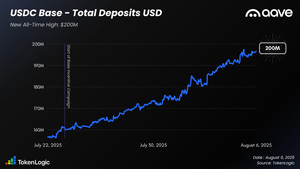

$200M of $USDC now deposited on Aave Base!

The Base Incentive Campaign was launched on July 23, and since then, USDC deposits on @base have grown by 22.7%.

This campaign was led by TokenLogic and @aavechan, with a clear objective: grow the Aave Base Market.

It seems the collaboration is working — the recent growth speaks for itself.

39,91K

70,000 $AAVE Bought Back!

Since launching the buyback program on April 9th, Aave DAO has accumulated 70,000 $AAVE, spending $15.7M at an average price of $223.33.

At today’s price of $261, these purchases are now worth $18.3M, a profit of $2.6M.

And now? Buybacks are still ongoing, with around $1M being deployed each week.

18,63K

.@aave's ETH holdings are now live on Strategic ETH Reserve 🦾

Very cool @fabdarice

fabda.eth4.8. klo 02.25

📊 SΞR UPDATE: @aave's treasury holds 11,593 ETH ($40M).

The leading DeFi lending platform is stacking ETH.

Big thanks to @Token_Logic for providing the accurate data.

4,02K

The most attractive place to earn yield on $USDC on Aave right now is @base.

Currently averaging 5.63%, that’s:

▪️ +1.2% higher than on Optimism

▪️ +1.4% higher than on Ethereum

▪️ +1.5% higher than on Arbitrum

And this doesn’t include the +1% additional APY available through Merit Program.

More than $186M of $USDC is already deployed there.

If you've got idle $USDC, it's time to make it work on Base.

11,89K

New incentives are live on Avalanche 🔺

Supply $GHO and earn 13.08% APY, currently the highest yield for stablecoin lending on @avax.

This includes a fixed 10% APR paid in $asAVAX, available until total deposits reach $50M — after that, the yield starts to dilute.

$asAVAX rewards are claimable on the ACI website.

Start earning here:

9,81K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin