Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

BitHappy

DeFi Pitfall Diary: When using lending and borrowing protocols, you need to check the borrow-to-lend ratio first!

Last night, a community member @dxh430 saw a mining opportunity with a 77.59% APR on USDC. After checking that the project had not been hacked, they deposited across chains.

This morning, they found they couldn't withdraw, and upon reviewing the project's DC information, discovered that the amount borrowed exceeded the amount deposited due to a vulnerability.

It seems this fund is unlikely to be recovered.

Another community member said: You need to check the borrow-to-lend ratio first!

11,93K

BitHappy kirjasi uudelleen

Ethena has opened up some USDe limits on Aave, but the speed of funds entering has slowed down.

This is mainly due to the uncertainty of the current 12% yield subsidy. My previous understanding was that the reward pool would match the opened limits, but the official response seems uncertain, and currently, there is no visibility on how much of the rewards have actually been allocated on Merkl.

If I were the project team,

Since we have chosen to pursue this growth channel outside of PT, it would be best to match the 12% yield. If that can't be matched, then control it through the limits rather than lowering the yield, otherwise, compared to other strategies, the attractiveness will significantly decrease.

33,67K

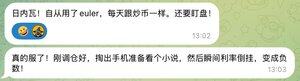

Today nothing is going well!

This morning the community had no water, and I started operating the USDe 49% APR circular loan strategy without even properly washing up.

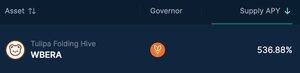

Meanwhile, the community is buzzing with enthusiastic discussions about the arbitrage opportunities from the drop in the sWBERA exchange rate and the skyrocketing deposit rates for BERA, which present hedging mining opportunities.

I originally planned to finish the USDe circular loan operation before diving into BERA.

Unexpectedly, when I was exchanging USDe on Arbitrum, I found that the Ethena official aggregator was showing a low price to buy USDe.

However, after struggling for over an hour, I couldn't buy in, so I thought I would first go for the sWBERA arbitrage opportunity of around 3.6% for 7 days (which translates to an APR of about 201%, and holding sWBERA also offers around 120% APR). Just as I was getting the money ready, the arbitrage space shrank to only 1.x%, and I instantly felt uncomfortable.

Now I'm trying to buy USDe at a low price, and I still haven't managed to do it. It's so frustrating!

18,65K

When the incentive is given in tokens, and the tokens increase three to four times in a week, then the APR skyrockets!

So, can BTC/ETH/USDC/USD1 all be deposited here?

Also, Lista has opened up PT-USDe collateral borrowing USD1 with an expiration in October, stacking on Dolo APR can exceed 36%.

Note: Dolo's interest incentives are updated weekly, and the actual returns may not be as high if the token price drops when interest can be claimed.

Tip: The above is for informational sharing only and is not investment advice; please do your own research!

DeFi enthusiasts: BitHappy

31,04K

RT @BitHappyX: Zhong Mining: 56% APR stablecoin strategy!

The bear market chain has triggered a series of butterfly effects after BGT's yield was cut by 33% for BERA.

The first to be affected is the decline in the exchange rate of various BGT relative to BERA, but what follows are many high-yield strategies surrounding BERA.

For example, currently, community members are discussing...

284

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin