Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Itai | dynamic.xyz

Acctual is what happens when you build for ops teams, not just crypto teams.

Welcome to part 5 of my series, stablecoin startups.

@AcctualTeam is building modern AP/AR tools for businesses that want to pay and get paid in both fiat and stablecoins. It's all integrated directly into platforms like QuickBooks.

This is important because most crypto payment tools are built in isolation from business software. Acctual is meeting teams where they already work and giving them a way to add stablecoin payments to familiar workflows.

We're powering their wallets and auth. It’s one of the clearest examples I’ve seen of crypto solving real, boring business pain.

615

In part 4 of stablecoin startups, I want to highlight Parfin.

They provide custody, tokenization, and infra for regulated financial institutions. They’re also building @RaylsLabs, an EVM-compatible chain designed for banks and fintechs.

Traditional institutions want to participate in crypto, but they need the right compliance tools, custody, and governance.

Parfin is giving them infrastructure they can actually use without compromising on crypto fundamentals.

Proud to support their wallet and auth flows so they can serve institutional customers securely and at scale!

PS - any other stablecoin startups I should highlight?

528

The next iteration of fintech will be global-first.

If this statement holds true, it means the next set of neobanks, Venmo-like apps, AP apps, and even treasury management apps will be global-first.

To increase your market from just the US or Europe or Asia to the entire world, you'll need to build on stablecoin rails.

Otherwise, it's very hard to create a global-first app.

951

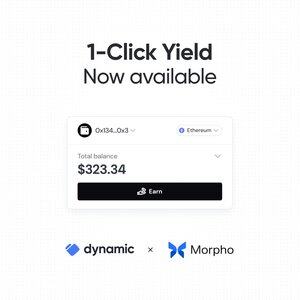

Most people holding stablecoins today earn zero yield, but that’s changing.

Today’s spotlight in my Stablecoin Startups series is @levelusd.

The team is behind lvlUSD, a yield-bearing stablecoin fully backed by USDC and USDT and integrated with protocols like @aave and @compoundfinance.

They’re turning stablecoins into native yield products, giving users utility without the usual DeFi complexity.

Proud to support Level with secure wallet and auth flows to help users onboard quickly.

1K

I’m loving this flow. Wallet infra powered by @dynamic_xyz

Linea.eth28.7.2025

Bridge to Linea and lock in for a big week.

We’ll cover your bridge fees.

Bridge in. DeFi up.

Powered by Linea and @Layerswap

526

If you’re exploring wallet infrastructure, there’s one question worth asking early:

𝐃𝐨 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐚 𝐜𝐥𝐞𝐚𝐫 𝐩𝐚𝐭𝐡 𝐭𝐨 𝐯𝐞𝐧𝐝𝐨𝐫 𝐢𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐜𝐞?

Most teams don’t think about it until a vendor goes down or sunsets a critical feature. Then everyone's stuck.

Threshold signature MPC is the only key management approach that provides a path to independent recovery.

With this type of MPC, you can:

- Let users store a backup share themselves (via Google Drive or iCloud) so they can recover offline

- Keep an additional backup share as the developer, so you can help users recover keys without having unilateral signing power

Vendor independence is critical to having a resilient product.

856

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin