Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Tom Dunleavy

Head of Venture @ Varys Capital | Ex: Sr. Analyst @ Messari | CFA/CAIA | NFA |

TG: dunleavy89 for dms

Is AAVE the most obvious buy in crypto?

TVL has historically been very correlated to price and has doubled the past few months without price following.

Massive usage coming from these DATs...

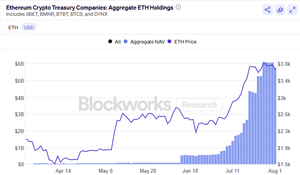

Tom Dunleavy4.8. klo 22.59

Everyone is looking at the first-order effects of spot buys for these DATS but absolutely NO ONE is ready for when these companies start to put this money to work on chain.

$6B+ injected directly into ETH Defi? LFG.

h/t @blockworksres

29,75K

Crypto in 401ks is WAY WAY BIGGER news than the ETFs

In the US, roughly 100 million Americans have a retirement investment vehicle known as a 401(k). Every 2 weeks, a portion of their paychecks are routed directly into purchasing a mixture of stocks and bonds. On autopilot. No discretion, just direct purchases based on their predefined allocations. Most Americans adjust these allocations annually, if at all.

This is a HUGE driver of the equity market run and resilience over the past 20 years. A constant background bid for assets.

In aggregate, this is ~$12T in assets with ~$50B of new capital flowing in every 2 weeks!

At a 1% portfolio allocation to crypto brings $120B in new flows

At a 3% portfolio allocation to crypto brings $360B in new flows

At a 5% portfolio allocation to crypto brings $600B in new flows

and these aren't one time flows. THEY KEEP BUYING ONCE ALLOCATIONS ARE SET.

401ks + DATs w/ at the money shelves put a ridiculous floor of crypto going forward and move the limit from the moon to jupiter.

Strap in 🫡

519,99K

Just snagged some @billions_ntwk on @KaitoAI.

I've personally never done anything on a launchpad but DID is such an obvious use case for crypto and I think this is the project to finally execute.

Killer team, killer investors, killer growth (1m+ users) and a huge advantage (Passport verification vs weird eyeball scans) over more well known name brands like Worldcoin.

6,71K

Tom Dunleavy kirjasi uudelleen

SBET has issued over 51m shares for $984m in proceeds over the last six weeks, equivalent to 58% of the current market cap

The proceeds were used to purchase what is now $1.6b of ETH

The ATM facility expanded from a $1b cap to $6b on July 24, enabling another $5b of share issuance. We can see Sharplink intends to drip shares onto the market each week at a rate of 3-10% of trading volume

SBET saw $3.7b in trading volume this week, so I'm estimating approx $110-$180m of shares were sold (3-5% of volume)

If you assume nothing breaks (!!), they are on pace to purchase another $3b of ETH this year

10,08K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin