Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ondo Finance

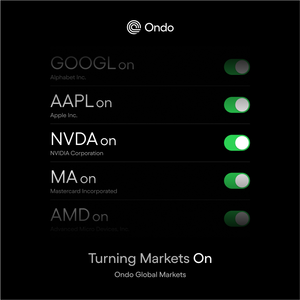

Institutional-Grade Finance. Onchain. For Everyone.

Backed by @foundersfund, @PanteraCapital, @coinbase.

The future of capital markets has no borders.

“Anyone with a stablecoin is going to essentially be able to buy any U.S. stock or ETF that they want... we really want to break open the barriers that currently still exist for a global user base.” - Ondo Finance's @iandebode on @CoinDesk's Ripple Effect.

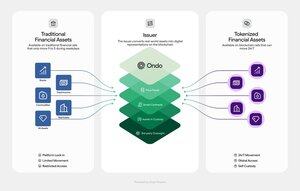

Ondo is building the infrastructure to bring traditional assets onchain, making institutional-grade financial products accessible to everyone, including on the XRPL (@RippleXDev).

30,62K

Drift joins the Global Markets Alliance.

Built for speed, scale, and high-performance DeFi, @DriftProtocol is a leading perp DEX on Solana combining advanced orderbook mechanics, real-time liquidity, and institutional-grade infrastructure.

As the Alliance grows to over 25 members, Drift strengthens the collective effort to bring tokenized stocks, ETFs, and more onchain with the right standards in place.

29,7K

The Global Markets Alliance continues to grow.

@glider_fi joins a community of 20+ industry leaders helping shape the future of tokenized capital markets.

Glider simplifies onchain investing through a non-custodial, automated platform aligned with the Alliance’s mission to build open financial infrastructure.

59,85K

Today, SEC Chair Paul Atkins announced Project Crypto in a landmark speech, a bold initiative to modernize U.S. securities regulation for the blockchain era.

His vision charts a clear path forward, one that embraces tokenized securities, stablecoins, and crypto-native infrastructure as core components of American capital markets.

Chairman Atkins acknowledged what many in the industry have long experienced: U.S. regulatory ambiguity pushed innovation offshore, leaving both entrepreneurs and investors behind. But the momentum behind tokenization is undeniable:

“...firms from household names on Wall Street to unicorn tech companies in Silicon Valley are lined up at our doors with requests to tokenize.”

Today’s message is unambiguous: the U.S. must lead in tokenized finance, not follow. At Ondo, we’ve long believed that real-world assets onchain are not a niche innovation, they’re the future operating system of global markets. Project Crypto proposes laying a framework for modernizing markets:

1. Regulatory clarity around tokenized stocks, bonds, and other securities

2. Support for compliant crypto asset distributions, including ICOs and airdrops

3. Modernized custody rules, reaffirming the right to self-custody

4. A vision for “super-apps” that unify crypto services under one regulatory umbrella

5. Innovation exemptions to bring breakthrough technologies to market faster

Legacy frameworks have excluded U.S. investors from innovation, and Project Crypto promises the opposite: a future where American capital formation happens onchain, and U.S. markets lead.

We are encouraged by Chairman Atkins' vision and committed to building the infrastructure that will power America's tokenized economy.

91,22K

Ondo Finance kirjasi uudelleen

As someone who’s been working on bringing real-world assets onchain for years, it’s incredibly meaningful to see the @realDonaldTrump administration not only embrace digital asset innovation, but also highlight tokenization as a pillar of U.S. financial leadership.

The report makes it clear that tokenization has entered the national conversation as a serious, strategic component of future financial infrastructure.

Grateful to see @OndoFinance featured, and proud of the team building the rails for this transformation.

35,45K

We’re honored that Ondo was featured in the @WhiteHouse report by the President’s Working Group on Digital Asset Markets, which recognizes tokenized securities, stablecoins, and programmable settlement as building blocks of the future financial system.

This recognition reflects a growing consensus: tokenization isn’t just an innovation, it’s the future operating system for traditional assets in a global, digital economy.

📄

At Ondo, this moment reinforces what we've been building toward for years: a more open, efficient, and globally accessible financial system powered by tokenized real-world assets.

We’re proud to have pioneered key infrastructure in this space, from launching the first tokenized Treasuries widely available to global investors, to building the first onchain financial protocol designed to support permissioned tokenized securities alongside stablecoins.

Now, with Ondo Chain, we’re creating a dedicated home for tokenized real-world assets, making it easier for traditional issuers to launch compliant onchain products, and enabling seamless integration between the worlds of traditional and onchain finance.

The report highlights tokenized funds and stablecoins as core infrastructure for modern markets. It emphasizes composability, auditability, and compliance as essential requirements, principles that have shaped Ondo’s architecture from day one. And it signals growing urgency for the United States to lead, not follow in the global transition to tokenized finance.

Ondo’s role in this next chapter:

1. Unlocking access: Making US assets globally available via fully-backed, compliance-first tokenized products.

2. Powering 24/7 markets: Enabling deliver-versus-payment settlement across a range of financial products, from treasuries to equities.

3. Bridging TradFi and DeFi: Connecting institutional-grade assets to programmable, interoperable blockchain infrastructure.

We're grateful for the leadership behind this initiative including @realDonaldTrump, @DavidSacks, @SecScottBessent, @BoHines, and the President's Working Group for recognizing the potential of tokenization to strengthen America's financial leadership.

We’re just getting started, and we’re excited to help shape the global financial system that comes next.

300,27K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin