Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Lai Yuen (Former .eth)

Investments @fisher8cap

The new degen loop for $ENA x $PENDLE x $AAVE:

1. Use USDe on Pendle to get PT for a zero-coupon bond w yield + low vol

2. Use that as collateral on Aave to borrow more USDC

3. Use USDC to get more USDe, start from step 1

Exogenous: USDC yield goes up, AAVE TVL moons again

shaunda devens7.8. klo 02.00

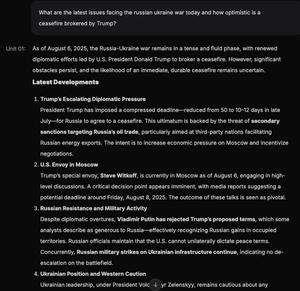

1/ Ethena's USDe supply is up $3.7B in just 20 days, driven primarily by the Pendle-Aave PT-USDe looping strategy.

With $4.3B (60% of total USDe) now locked in Pendle and $3B deposited in Aave, here's a breakdown of the PT loop mechanics, growth vectors, and potential risks:

14,17K

Lai Yuen (Former .eth) kirjasi uudelleen

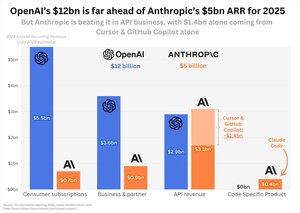

OpenAI and Anthropic both are showing pretty spectacular growth in 2025, with OpenAI doubling ARR in the last 6 months from $6bn to $12bn and Anthropic increasing 5x from $1bn to $5bn in 7 months.

If we compare the sources of revenue, the picture is quite interesting:

- OpenAI dominates consumer & business subscription revenue

- Anthropic just exceeds on API ($3.1bn vs $2.9bn)

- Anthropic's API revenue is dominated by coding, with two top customers, Cursor and GitHub Copilot, generating $1.4bn alone

- OpenAI's API revenue is likely much more broad-based

- Plus, Anthropic is already making $400m ARR from Code Claude, double from just a few weeks ago

My sense is that Anthropic's growth is extremely dependent on their dominance in coding - pretty much every single coding assistant is defaulting to Claude 4 Sonnet. If GPT-5 challenges that, with e.g. Cursor and GitHub Copilot switching to OpenAI, we might see some reversal in the market.

232,97K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin