Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Aylo

This is the first time all cycle that BTC.D hasn't rocketed back up after seeing a steep decline.

That 50 week EMA has been respected since early 2023, and its looking like it wants to fall through it now.

ETH treasury companies largely responsible as they are looking to push ETH through that $4K level asap.

Algos all firing on alts as a result and taking the signal.

19,64K

Szn 4 is live on Kamino!

No more points, you will earn fixed KMNO tokens (with some vesting). You can see exactly what you are earning.

Earn KMNO on top of what was already good stablecoin yield in these three vaults, with strategies run by risk managers.

You will generate a bigger return if you stake some KMNO.

UI and analytics on Kamino remain the best in DeFi.

You will see your interest earned, claimable rewards and Szn 4 KMNO generating in real time all transparently for you.

Nice overall update here.

Kamino19 tuntia sitten

1/ Kamino Season 4 is now live

A full overhaul of Kamino's rewards system, Season 4 will have a fixed KMNO allocation, a fixed duration, and transparent user rewards

Season 4 Hub:

Welcome to a new era ⤵️

16,56K

Chainlink is one of the biggest success stories in crypto, but the $LINK token hasn't yet captured that value.

Looks like things are changing. Off-chain revenues will be buying back the token.

We already know those revenues are huge, but the question is how much will be used for these buy backs.

You will be able to monitor those flows in their dashboard, so can assess in a few weeks.

Theoretically, this should eventually be significant, as all Chainlink products/services are up only in adoption, and this is the beginning of some of that flowing to token holders.

Chainlink21 tuntia sitten

We're excited to announce the launch of the Chainlink Reserve, a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens.

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by accumulating LINK tokens using offchain revenue from large enterprises that are adopting the Chainlink standard and from onchain service usage.

The Chainlink Reserve is being built up by using Payment Abstraction to convert offchain and onchain revenue into LINK, using a combination of Chainlink services and decentralized exchange infrastructure.

Demand for Chainlink has already created hundreds of millions of dollars in revenue, substantially from large enterprises that have paid offchain for access to the Chainlink Platform.

With increasing demand from a number of the world’s largest banking and capital markets institutions, this form of paying for the Chainlink standard is expected to grow into the future as the industry grows.

The Reserve has already accumulated over $1M worth of LINK from this early stage launch phase, which is expected to gradually grow in the coming months as more revenue is converted into LINK and placed into the Reserve.

We do not expect any withdrawals from the Reserve for multiple years and thus it is expected to grow over time. We believe that as the industry demand for Chainlink’s unique capabilities increases, that adoption of Chainlink services will enable the Reserve to grow further.

🧵👇

23,02K

Bullish catalysts for crypto:

• SEC's "Project Crypto" - bringing US markets onchain and allowing crypto builders to innovate with clear rules is not priced in

• US citizens being able to invest in crypto using their 401(K)s - big source of new passive flows

• Digital Asset Treasury bubble (or ponzi - choose your word) growing much bigger

• Global interest rate cuts still to come, most notably from the Fed (traders pricing in a cut in September now) - the UK cut again today

• GENIUS Act makes USD-backed stablecoins fully legal & regulated in the U.S, unlocking massive institutional adoption

Higher.

6,84K

We had a small correction and traders started writing the obituaries again.

ETH/BTC has a lot of room to run and looks good on HTFs.

ETH/USD looks good and it is going to break through that $4k level eventually.

That final boss is going to get defeated.

Tom Lee has told you his company will buy 5% of the ETH supply, and you have Lubin racing to keep up, alongside other treasury companies.

With this buying pressure you also get the crypto natives jumping on the ETH bandwagon again contributing their liquidity.

Ultimately, you can keep it simple: there are more buyers than sellers for the foreseeable future.

Get off the hourly charts, zoom out and enjoy the ride up.

60,09K

We had a small correction and traders started writing the obituaries again.

ETH/BTC has a lot of room to run and looks good on HTFs.

ETH/USD looks good and it is going to break through that $4k level eventually.

That final boss is going to get defeated.

Tom Lee has told you his company will buy 5% of the ETH supply, and you have Lubin racing to keep up, alongside other treasury companies.

With this buying pressure you also get the crypto natives jumping on the ETH bandwagon again and contributing their liquidity.

Ultimately, you can keep it simple: there are more buyers than sellers for the foreseeable future.

Get off the hourly charts, zoom out and enjoy the ride up.

4,64K

Selling $HYPE before HIP-3?

ngmi

The biggest catalyst is yet to come.

Keisan.hl5.8. klo 23.35

(1/8) HIP-3 Is an X-Factor for Hyperliquid 🧵

Thread below on HIP-3's potential and what it means for Hyperliquid, as well as crypto as a whole

TLDR; the TAM just got a lot bigger

10,33K

Aylo kirjasi uudelleen

Guy @gdog97_ recently appeared on bidclub podcast to talk about Ethena / ENA, think most people missed it, so here's a quick summary/highlights of new info:

Growth:

Aiming to scale to $30–50B USDe (or equivalent) USDe supply before aggressively monetizing

On track to exceed $12B by Q3; internal goal is $15B+ by year-end

Opex is only ~10m/yr, TINY compared to CRCL, and cash reserves sufficient to meet needs w/o using protocol revenue

Revenue forecast:

up to 400m a year w/ 20% take rate (would make Ethena the second largest revenue generating protocol behind Hyperliquid which has an associated token)

New products:

We all know about Ethereal perps DEX launching with Converge chain soon.

We know about stablecoinX DAT equity formerly launching later this year

iUSDe launching to allow tradfi asset managers to buy USDe in a regulatory safe wrapper

THE BIG ONE:

With HIP-3 launching on Hyperliquid soon™ people will be able to launch their own perps markets.

There are (external) teams planning to launch USDe paired perps - this could be very big - the yield from holding positions in these perps can significantly offset funding fees. Guy estimates that it could quickly net Ethena an additional 100m in revenue.

secondary to the above, they may well start doing the carry trade on hyperliquid (they currently don't, which is partially why funding is often higher than CEXs) - they would isolate the higher risk by launching a NEW stable product - something like hUSDe - which would likely have higher yield than USDe, but be isolated from causing contagion if hyperliquid blew up for whatever reason.

Other bullish stuff:

With rate cuts coming, and Spark (SPK) having more flexibility in deploying USDS/DAI to maximise yield, Guy forecasts up to 30-50% of that stable could end up being backed by USDe.

The team have seen interest from tradfi funds in the stablecoin X DAT, and they realise they need to pitch it and sell it see the flows come in

I could not be more bullish on ENA.

21,21K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

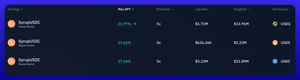

Viimeisimmät suosituimmat rahoitukset

Merkittävin