Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

⬡ The_Crypto_Oracle ⬡

I'm an independent researcher and writer for @SmartContent777. I believe smart contracts are the foundation of a new wave in automation. Opinions are my own.

⬡ The_Crypto_Oracle ⬡ kirjasi uudelleen

Summary of today:

1. Chainlink has already made hundreds of millions in historic revenue, primarily through off-chain enterprise deals. All of that historic revenue will now become onchain token buybacks.

2. The future fees will be in billions because Chainlink is the most widely adopted protocol in crypto with the widest range of products. No other platform does what Chainlink does; only fractions.

3. The best BD team in crypto, which has on-boarded more TradFi onchain than any other protocol, now works for you, the LINK token holders.

All of these enterprise announcements, such as what I linked, will go into production, and the revenue of these off-chain enterprise deals become on-chain token buybacks.

No one else has this. Chainlink even has deployments on permissioned/private chains, where you can't even get exposure any other way than buying LINK.

Chainlink is the pinnacle bet to get exposure to TradFi coming onchain, tokenization, stablecoins, everything, because no protocol can do what Chainlink does and no one has more adoption than Chainlink.

49,94K

Step1: Tradfi institutions & DeFi protocols pay to use Chainlink services however they want (onchain or offchain, in fiat or crypto)

Step 2: Revenue from payments is converted to LINK

Step 3: LINK is stored in the Chainlink Reserve

As demand for Chainlink grows, so does demand for LINK

Chainlink7.8. klo 21.00

We're excited to announce the launch of the Chainlink Reserve, a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens.

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by accumulating LINK tokens using offchain revenue from large enterprises that are adopting the Chainlink standard and from onchain service usage.

The Chainlink Reserve is being built up by using Payment Abstraction to convert offchain and onchain revenue into LINK, using a combination of Chainlink services and decentralized exchange infrastructure.

Demand for Chainlink has already created hundreds of millions of dollars in revenue, substantially from large enterprises that have paid offchain for access to the Chainlink Platform.

With increasing demand from a number of the world’s largest banking and capital markets institutions, this form of paying for the Chainlink standard is expected to grow into the future as the industry grows.

The Reserve has already accumulated over $1M worth of LINK from this early stage launch phase, which is expected to gradually grow in the coming months as more revenue is converted into LINK and placed into the Reserve.

We do not expect any withdrawals from the Reserve for multiple years and thus it is expected to grow over time. We believe that as the industry demand for Chainlink’s unique capabilities increases, that adoption of Chainlink services will enable the Reserve to grow further.

🧵👇

11,84K

⬡ The_Crypto_Oracle ⬡ kirjasi uudelleen

JUST IN: @chainlink has officially launched the Chainlink Reserve 👀

This economic upgrade creates a strategic LINK reserve funded by onchain & offchain revenue

Institutional adoption → protocol revenue → LINK purchases → Reserve

Here's what this means for $LINK 🧵👇

195,5K

⬡ The_Crypto_Oracle ⬡ kirjasi uudelleen

As you build more complex use cases spanning numerous chains, jurisdictions, and infrastructure requirements, you need a protocol that can execute workflows across all these disparate systems & counterparties.

This is why Chainlink is the backbone of the new financial system.

17,54K

⬡ The_Crypto_Oracle ⬡ kirjasi uudelleen

Just over a month ago, @xStocksFi announced Chainlink as the official oracle powering the pricing of all its tokenised equities and ETFs.

One of the key differentiators of Chainlink’s oracle solution lies in its data schema, which is built to meet the requirements of institutional-grade financial applications.

Chainlink reports are structured using flexible schemas that support multiple data fields relevant to market context, including:

- Market status indicators that signal whether a market is open or closed

- Staleness detection that helps applications assess data freshness during anomalies such as trading halts or geopolitical events

- Circuit breaker readiness to support safeguards that programmatically trigger market pauses and position freezes during disruptions, including stock suspensions and exchange outages

The depth of data delivered within each report is just as critical as the breadth of symbols supported.

Just use Chainlink ⬡

6,13K

⬡ The_Crypto_Oracle ⬡ kirjasi uudelleen

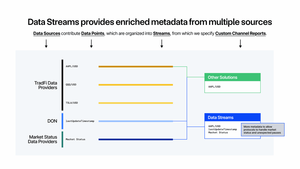

Chainlink’s RWA Data Streams aren’t just regular price feeds, they’re smart streams that contain the metadata needed to reliably support these complex markets onchain.

TLDR

⬡ algorithmic pricing

⬡ market status indicators

⬡ staleness detection

⬡ Circuit breaker readiness

And of course, all of this data is customizable end-to-end. You decide what data you want, and how you want it packaged into a custom channel report tailored to your application.

5,03K

⬡ The_Crypto_Oracle ⬡ kirjasi uudelleen

Chainlink continues to SHIP 🚢🚢🚢

State Pricing is a new pricing methodology for @Chainlink Data Feeds and Data Streams, optimized for long-tail & DEX-traded assets

Complementing existing VWAP-based pricing methodologies, State Pricing provides devs more choice on how to price newer and more niche assets that have notable onchain liquidity but lower volume on CEXs

Initially supported assets include as wstETH, GHO, LBTC, cbBTC, ezETH, tBTC, and more, which is being adopted by @aave, @LidoFinance, @GMX_IO, and @CurveFinance (mixture of consuming protocols, asset issuers, and DEX data sources)

This pricing methodology has a lot of nuance in how it provides reliable pricing, taking into account data from numerous chains and DEXs, so dive into the blog to learn the details:

23,31K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin