Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Vand Ni|Asian bro

Web3 Native with Integrity | Candle 🕯️ Litter|Builder full of optimism and energy; Kindness first, the number one customer service in the community, be a charismatic researcher

Congratulations to BNB for breaking its all-time high a few days ago. To be honest, this was expected. I believe BNB has inevitably become one of the longest-term assets.

Because BNB is currently the most well-rounded token among all tokens.

- Binance exchange buybacks (supported by a top CEX), recently everyone seems to be into trading meme stocks, but no one realizes that BNB is essentially Binance's stock, the most authentic RWA concept.

At the same time, with Binance Alpha's support, there are continuously new assets being issued on-chain.

10X Capital and YZi Labs have also started collaborating to push BNB into the traditional financial market.

BNB has gradually detached from the concept of being just a Binance platform token:

- A well-developed infrastructure ecosystem

- Becoming a high-performance public chain

- More active users and stablecoin asset support... Many friends only buy tokens and don't sell them; only buying BTC/ETH without selling won't make you lose money, and BNB currently seems to be the third one.

Congratulations on BNB's ATH, and if there's a pullback, I'll add some more.

37.03K

B3 is currently the undisputed leader in Consumer practices, improving infrastructure and promoting ecological prosperity.

In this field, what are the long-term holdings worth considering?

What is the next focus centered around BASE?

If Payfi was a hotspot in the past, does consumerfi also have a chance?

Tonight at 20:00, I will discuss these topics with @zorarara_0209 and share insights on recent wealth codes worth paying attention to.

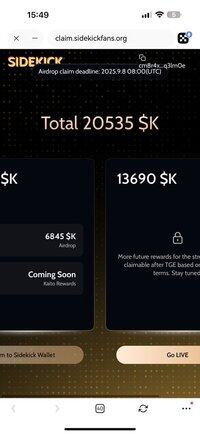

Multi-platform: @nihaovand_live @nihaovand @Sidekick_Labs will be co-broadcasting.

12.01K

In the past few years, we have been overly focused on building infrastructure and PVP, everything revolving around "financial gamification." But in this round of altcoin season, we see that this narrative has hit a bottleneck: liquidity is no longer increasing, Ponzi schemes are unsustainable, and creativity is starting to stagnate.

But there is one signal that is becoming stronger: people are starting to consume on-chain.

It's not about "completing tasks for money," but rather about creating memes, buying coins, generating NFTs, expressing emotions, and voting to support their favorite projects or communities. This is the embryonic form of consumer behavior and the manifestation of emotional value.

Base3, which I have been participating in and following for a long time, happens to be a set of products that align with this rhythm. It is not about "creating a product," but rather building a complete consumption path from Web2 to on-chain.

The problem it addresses is something I have been pondering since I started in this industry:

When the chain really starts to mainstream, who can catch these real users?

And the solution that B3 provides is not to educate users on how to use wallets, nor to make users study chain names and transaction fees, but to create an "effortless" onboarding path:

- Apple Pay / credit card direct deposits (Anyspend)

- Support for cross-chain payments and purchases

- One-click token issuance (Bond Launchpad)

- Natural language NFT generation (Spawn)

- A fully visual interactive entry point for the ecosystem (B3 Explorer)

Each tool is not a demo but a product that is already live and can be directly experienced.

It is not solving the problems of old users in the crypto space, but rather focusing on "allowing those who do not know how to use wallets to participate on-chain." I believe this is a more constructive direction.

The underlying logic of these products all revolves around $B3 to form a value loop:

- All ecosystem products are powered by $B3

- All transaction fees and usage behaviors will repurchase $B3

- B3 will also publicly disclose the treasury wallet, and all income will be visible on-chain

This model is not driven by expectations but is constituted by real transactions and usage behaviors. This is what I call the embryonic form of "real consumption."

If you are also paying attention to consumers, or are working in areas related to culture, social interaction, and on-chain experiences, I recommend seriously studying B3's products and rhythm.

It does not seem to be created just to ride this bull market; it feels more like an operating system prepared for the next real user cycle.

It is worth a thorough study by all builders and investors focused on consumers and mass adoption.

13.27K

The minting volume of SEI USDC should have already surpassed that of Algorand, which is quite noteworthy.

I previously traded Algo, which tripled, but the holding process was quite painful. I'm paying attention to SEI because I feel it might have a similar pump trend as Algo.

The minting volume of Base USDC is about $370 million, while SEI is currently at $160 million. However, SEI has only launched its native USDC minting for 2 weeks, which indicates that Circle's support is quite strong.

Circle invested early in SEI, and SEI is currently their largest holding. It's hard to estimate Circle's cost basis in SEI, but they have chosen to heavily invest in holding + stablecoin support.

I predict a few strategies:

1. Deeply engage with SEI, using it as a base for expanding the stablecoin market.

2. Learn from Sui to drive stablecoin + DeFi business to promote the ecosystem.

3. Operate the token to seek greater profits. Of course, it can also be said that they are building the next world-class public chain.

At the new price point, let's first establish a small observation position.

21.8K

Suddenly discovered that I still have a box of AsianOnChain merchandise at home that hasn't been sent out.

There are also various merchandise from major projects, so let's kick off a merchandise giveaway day!

Leave a comment sharing your life, and we'll randomly select various merchandise. Let's all stick together in Crypto ☀️ @nihaovand_live

10.09K

In fact, over the past period, I have accumulated a substantial position in Plume, with this trade valued at around $1M when the cost was $0.092 , because I believe Plume, as the leader of the RWA narrative in this cycle, can play a crucial role.

At the same time, I have called on miners and some wealthy individuals to join me in holding this token with significant capital.

However, in the past month, Plume has almost missed every upward cycle. From my observation, the obvious reason (this is just my analysis) is that the token consistently faces selling pressure right before an uptrend begins. They tend to sell before Plume breaks out for a rally, aiming for a 10% profit. The scale of these funds is roughly $3–5M.

This is an inherent flaw in Plume’s token distribution structure — the lack of a spot market pool on top-tier exchanges results in extremely low liquidity. @plumenetwork @plumeinchina

There’s nothing wrong with selling for short-term profits; I’m merely stating this phenomenon. Perhaps I will also exit my Plume position at some point, or perhaps I will continue holding. #plume $plume

9.21K

Vand Ni|Asian bro reposted

Everyone thinks I received a lot of airdrops, but I really didn't.

I didn't post much because I was afraid you'd laugh at me for not ranking high enough.

I came to live stream not for the so-called airdrops, so I make big money while some people make small money.

In these few months of live streaming, I've worked hard and gained fans and built a community.

I've acquired many million-dollar watches, jewelry, and sports cars; the so-called airdrops aren't worth as much as a single ring of mine.

I previously showcased a sports car, and it got a lot of attention; everyone only saw the car's value but didn't realize this bracelet is worth more.

Just like many people can only see the surface, this world rewards builders, rewards those who move forward, and does not reward those who hold others back.

If you feel resentful, it's not because everyone should treat you better; it's because you are the weak one.

The project hasn't done anything wrong; what do you want with all this FUD? If you really want to make money, I suggest you turn around and become a builder.

The saying "the crying child gets the milk" is just a rule from elementary school; if you want to win, if you want victory, you should bravely return and join in.

12.06K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable