Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

66% of Bitcoin hasn’t moved in over a year.

Most people just sit and hold Bitcoin, leaving it as unproductive capital.

But what if you could finally put your Bitcoin to work and earn up to 21% yield while still keeping ownership?

That’s exactly where @yalaorg comes in.

Let’s dive in 👇

1/ What is Yala?

Yala is a Bitcoin-native liquidity protocol that lets you earn real-world yield on your Bitcoin without giving up ownership.

It unlocks a path for BTC holders to finally put their capital to work, solving one of Bitcoin’s biggest barrier: sitting idle.

Yala’s mission is to make Bitcoin productive without sacrificing custody, and securely bridging to DeFi + RWA yields.

2/ How Yala Yield Works

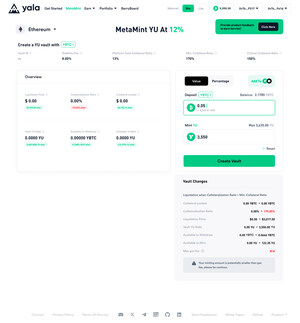

Yala's process is straightforward. You connect your BTC and destination chain wallets → deposit BTC → receive YBTC in return.

YBTC acts like wrapped Bitcoin and is used to mint Yala’s native stablecoin, $YU.

With $YU, you can earn yield by:

• Staking in stability pools

• Farming by adding liquidity

• Using different strategies in the DeFi marketplace

The gist is your BTC is collateralized to mint their stablecoin $YU, which you use to earn yield across DeFi and RWA opportunities.

Plus, every onchain action earns you “Berries,” making you eligible for future airdrops.

3/ $YU's Track Record

$YU is an overcollateralized stablecoin backed by BTC in Yala’s MetaVault.

It uses a strict CDP (collateralized debt position) model, so every $YU is only minted when users lock BTC as collateral. This ensures borrowing is within safety limits at all times.

So far, ~$120M in $YU has been minted while Yala’s TVL is at ~$210M (95%+ in BTC deposits).

4/ RWA Integrations

Yala doesn’t only rely on DeFi yields.

They integrate real world assets (RWAs) to generate sustainable and stable APYs even during slow DeFi periods.

Phase 1 focuses on tokenized low-risk assets like T-Bills and government bonds for stable yields (better for passive players)

Phase 2 look at advanced TradFi strategies like market-neutral funds and tokenized credit for diversified yield (more advanced method requiring more focus on risk management)

With partners like @centrifuge, Yala gains compliant and transparent access to RWAs, helping BTC holders earn real yield even during slow DeFi periods.

5/ Yay-agent

If you don't have time to look for the best yield strategies, Yay-agent will do it for you.

Yay-Agent is an AI-powered $YU farming strategist, helping you earn more yield without any hassle.

Built on Coinbase’s AgentKit + Deepseek, it scans onchain data, finds the best yield opportunities for $YU, and offers:

• Strategy optimization (AI)

• Real-time risk alerts (impermanent loss, liquidation, protocol risks)

• One-click asset management across chains

Pretty convenient that your BTC works for you while you can focus on other things.

1,74K

Johtavat

Rankkaus

Suosikit